Explain the Difference Between a Drawer and a Drawee

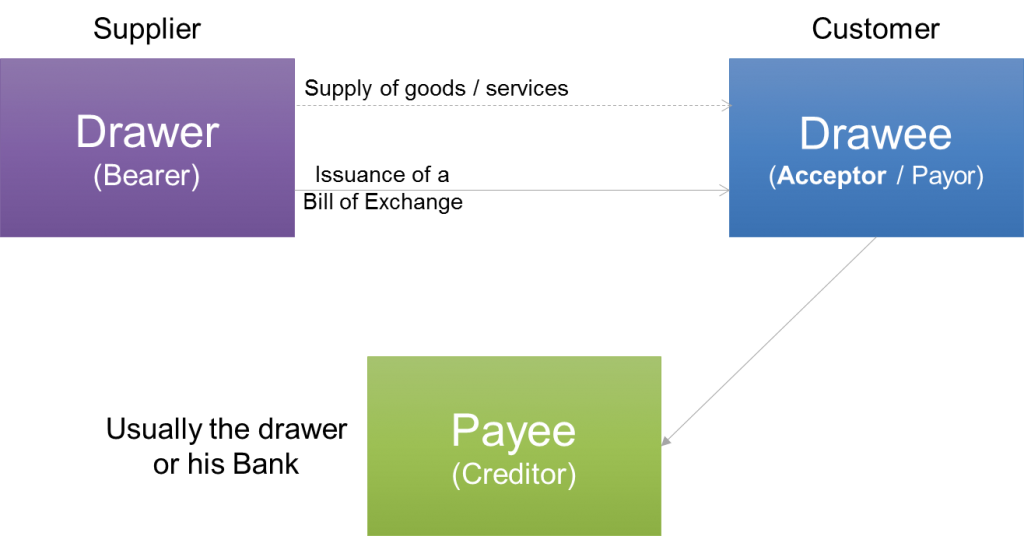

The payee is the one that is owed money. Firstly It is generally drawn by the creditormaker or drawer on his debtoracceptor or drawee and the debtor gives the acceptance that he will pay the money to the makerdrawer after some certain period or a specific date.

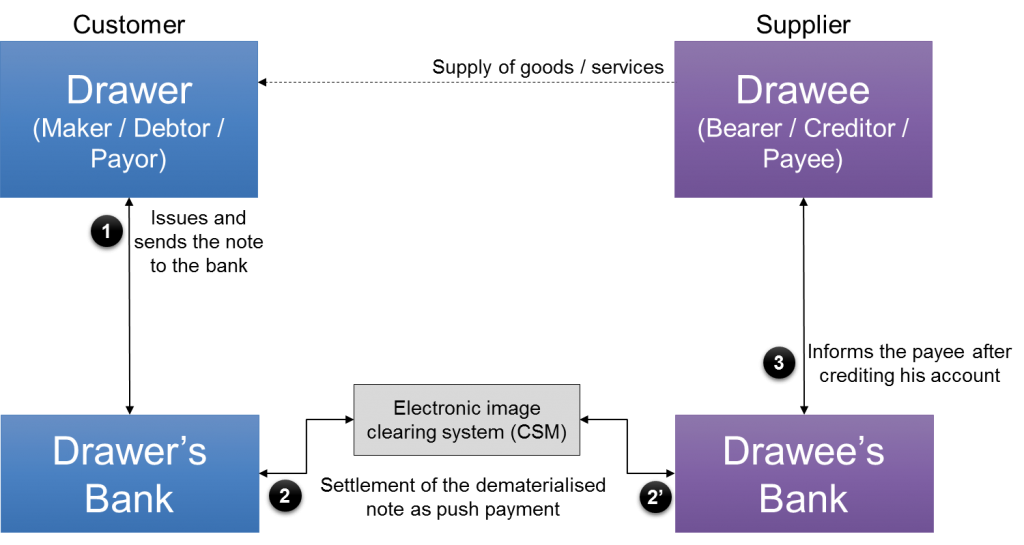

The Four Corner Model For Promissory Notes Paiementor

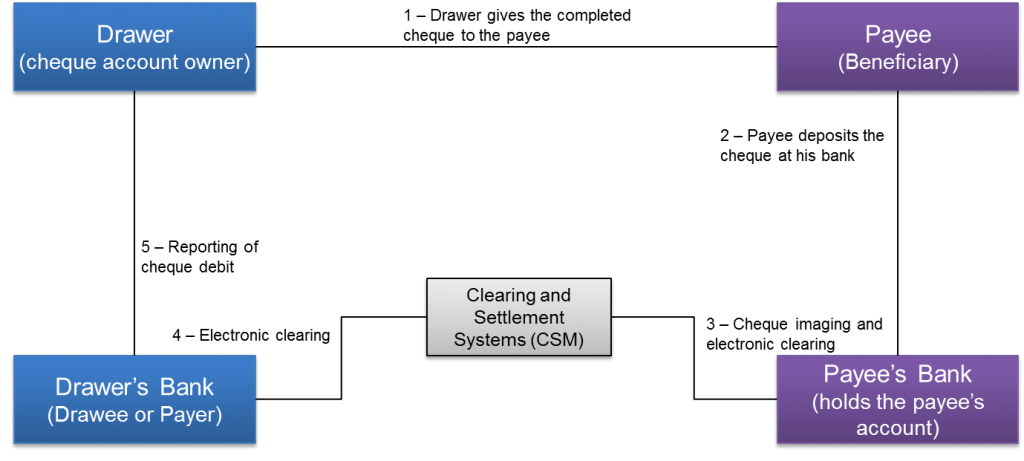

Key Differences Between Cheque and Bill of Exchange.

. The bill is signed by Drawer. When you put money in the business you also use an equity account. What You Need To Know About Bill Of Exchange.

It pays from the balance in the customers bank account. PARTIES OF CHEQUE. The drawer and the payee are the same entity unless the drawer transfers the bill of exchange to a third-party payee.

The drawer is the person who writes the check although they must have the authority to do this. Why should check stubs be filled out first before the check itself is written. Depending on the use of the drawer you may require a 75 slide which extends the drawer out to 75 the length of the slide or a full extension which will extend the drawer outwards to 100 of the length.

Click to see full answer. A drawee is the person or other entity that pays the owner of a check or draft. The drawee is the other main party involved in the bill of exchange.

In case of dishonour of cheque or bill of exchange by the drawee or the acceptor the drawer of such cheque or bill of exchange needs to compensate the holder such amount. The holder of the check is the payee and the check writer the drawer. Owner Equity parent account Owner Draws sub account of owner equity Owner Investment sub account of owner equity View solution in original post.

The person who makes or executes the note promising to pay the amount stated therein. But the drawer needs to receive due notice of dishonour. Drawee is the person who needs to pay the amount to the drawer.

Payee the payee is the person to whom the order the check is made out. A Drawee may honor the check and charge Drawers account for 1000. Payee is the person whose name is written on the promissory note or bill of exchange or cheque.

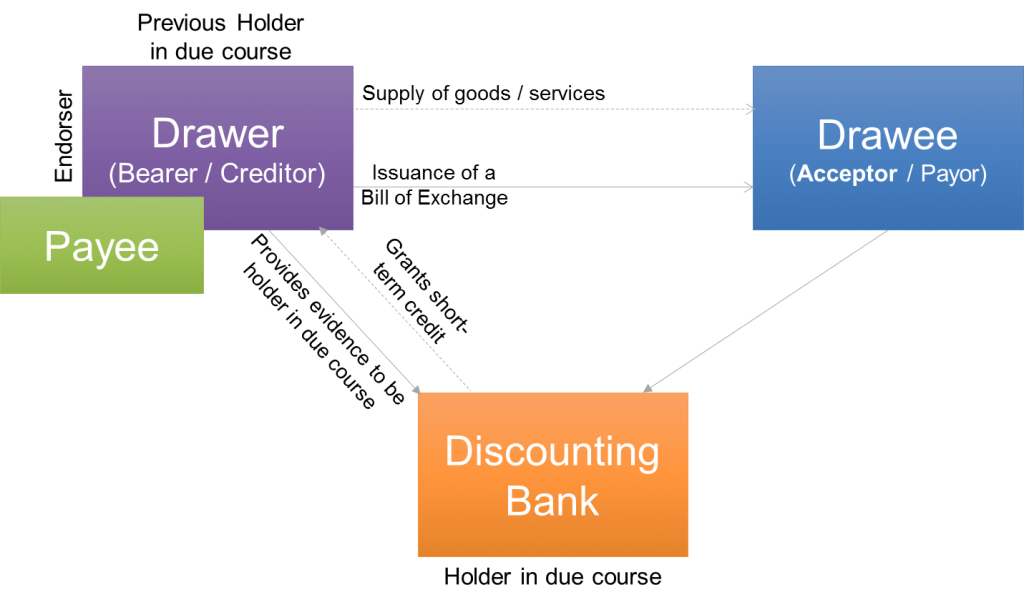

That implies the drawer who originally demanded the money is not always the one who should be paid. A creditor who is entitled to receive payment from the debtor can draw a bill of exchange. Explain the difference between payee drawer and drawee.

Payee is the person who receives the payment. So your chart of accounts could look like this. A bill of exchange often includes three partiesthe drawee is the party that pays the sum the payee receives that sum and the drawer is.

The bill is made and signed by the drawer and accepted by the drawee. Drawee the drawee is the bank with which the drawer has a bank account. A bank statement is sent twice a month.

Owner draw is an equity type account used when you take funds from the business. The bill of exchange has three parties named as-drawer drawee and payee. It is the person who makes the bill and orders the drawee to pay a certain sum of money to the payee.

On the other hand a promissory note carries an unconditional promise by the maker to pay to the payee. The person who makes the bill or who gives the order to pay a certain sum of money. Students also viewed these Cost Accounting questions Explain the difference between accounting value added earnings and shareholder value added.

Drawee is the debtor who has to pay the money to the drawer. Drawer the drawer is the person who writes or issues the check. The parties to the bill of exchange must be certain.

If Drawer and Drawee have no agreement concerning overdrafts. The person directed to pay the money by the drawer. Explain the difference between payee drawer and drawee.

It contains a pre-determined date on which the payment is to be made to the payee. I hope I did help you. The drawee is the one who is obligated to pay.

Drawer is the person who issues the instrument in order to receive a payment. The drawer is the maker of a bill of exchange. The drawee is the place bank where the check is drawn out of.

He is directed to. In other way the personcompany from whose account money is drawn is known as drawer the bank who is facilitating withdrawal of money from personcompany account is known as drawee and the person who is paid money is known as payee. Drawer means a person who signs a cheque or a bill of exchange ordering his or her bank to pay the amount to the payee.

And finally the payee is the person who receives the payment when the check has been cashed by the drawee bank. The drawer generally issues the bill as part of a domestic or international commercial transaction to receive payment for value delivered. The payee is the one who receives that sum.

B Drawee may honor the check and charge Drawers account for no more than 975. The slide extension is the length to which the drawer will pull out from the drawer unit in other words the full drawer length when open. The person who accepts the bill of exchange or who is directed to pay a certain sum.

Now regarding their meaningthere is no difference. In a bill of exchange according to the drawers direction there is an unconditional order that is there for the drawee to make the payment. They are ways of payment which operate in a way similar to a chequebut the drawer is the same as the payee that is the beneficiaryInstead of there being three parties involved in the cheque there are only two.

He is also known as Acceptor. The drawee is the paying bank in case of cheque. Drawee is the person upon whom the bill of exchange is drawn.

And the bank of course. Drawer has only 975 in the account. The person receiving payment he or she can be a designated person or the drawer himself.

The drawee is the party that pays the sum specified by the bill of exchange. The drawer is the party that obliges the drawee to pay the payee. The drawer is the person who creates the bill and issues the payment order.

Drawer writes a 1000 check on her account at Drawee Bank. Secondly It should be accepted by the person to whom it is created or by another person on hisher behalf. In most cases the drawer and the payee are the same individuals unless it is transferred to third party payee by the drawer.

It can be payable on demand when the bill is discounted with the bank.

The Four Corner Model For Cheque Payment Paiementor

Comments

Post a Comment